Tax Guidance for Swedish Residents with Indian Income

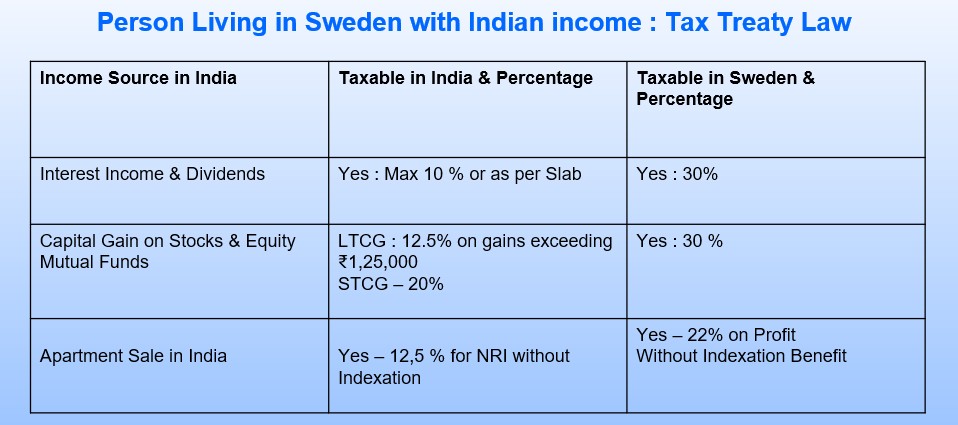

As a tax resident of Sweden earning income from India, you have tax obligations in both countries. The India-Sweden tax treaty (DTAA) is designed to prevent double taxation, ensuring you don’t pay tax twice on the same income.

1. In India (The Source Country)

First, we report your Indian income (such as rent, capital gains, or salary) in India.

We then calculate and pay any taxes due, strictly following Indian tax law and the benefits available under the tax treaty.

2. In Sweden (Your Country of Residence)

Next, you must declare your worldwide income, including the income from India, on your Swedish tax return.

We will report the final tax you’ve already paid in India.

The Swedish Tax Agency (Skatteverket) will then grant a Foreign Tax Credit for the taxes paid in India. This credit reduces your Swedish tax liability on that income, effectively preventing double taxation.

I create awareness on personal finance topics to European Indian NRI and Swedish expats by empowering them to have control over their finances and a fulfilling life with happier relationship with money

[contact-form-7 id=”e6bb714″ title=”Home 2 (subscribe)”]